10 September 2024

Power Metal Resources PLC

("Power Metal" or the "Company")

Letter of Intent signed with Al Masane Al Kobra Mining Company ("AMAK")

Power Metal Resources PLC (AIM:POW, OTCQB:POWMF), the London listed exploration company with a global project portfolio, is pleased to announce the signature of a Letter of Intent ("LOI") to enter into a binding agreement with Al Masane Al Kobra Mining Company ("AMAK"), a Saudi Arabian listed exploration and mining company, for Power Metal to spend US$3,000,000 to earn a 49% stake in the Qatan exploration licence ("Qatan"), in southern Saudi Arabia (the "Proposed Agreement").

AMAK is a leading publicly listed mining company in Saudi Arabia (listed on the Saudi Arabia stock exchange Tadawul: 1322 AMAK) with two mines producing copper and zinc concentrates, and gold and silver ore. In addition AMAK has 21 exploration tenements throughout Saudi Arabia covering base and precious metals and industrial minerals to support long term mining activities through further discoveries. As part of the Proposed Agreement, AMAK will work alongside Power Metal in order to maintain excellent local stakeholder relations, support exploration activities, and manage all statutory requirements associated with AMAK's tenement obligations. The Power Metal technical team will be responsible for designing, conducting and funding all exploration and resource work up to the earn-in amount.

Further to detailed discussions, the Company has proposed a comprehensive exploration programme at Qatan to satisfy the definition, if applicable, of an accredited initial Mineral Resource Estimate ("MRE") for the Habdah prospect, located within Qatan. In addition, Power Metal will advance exploration across the entire licence to define any further potential mineralisation.

A formal and legally binding agreement containing the full terms and conditions of the Proposed Agreement shall be executed by the Parties within 90 days of executing the LOI. Although there can be no certainty at this stage given the non-binding nature of the LOI, the Directors remain confident that the agreement will become binding subject to further discussions between the parties. Further announcements relating to the Proposed Agreement will be made as appropriate.

Sean Wade, Chief Executive Officer of Power Metal Resources plc, commented:

"This is a significant development for Power Metal with a major Saudi Arabian mining company, marking a further milestone in the Company's expansion into the Arabian Shield. We are delighted to have the support of AMAK and enter into this LOI with the hope of commencing work at the Qatan exploration licence in the coming months.

"We look forward to optimising the potential of Qatan and will provide updates to the market as our collective work progresses."

Geoff Day, Chief Executive Officer of AMAK, commented:

"AMAK is delighted to sign this LOI with the intention to partner with Power Metal Resources in fully defining the economic potential of its exploration assets in the most timely and efficient way. Recognizing the mutual strengths of strategic alliances such as this allows AMAK to focus on its core business while at the same time working towards developing the full potential of the Kingdom of Saudi Arabia's mineral endowment under vision 2030."

Power Metal proposes to use a wide variety of industry-accepted exploration techniques to advance the license, including, if applicable, defining an initial MRE with Industry-standard technical work to be carried out at every stage to ensure best practices and enable any new data to qualify for inclusion in an accredited MRE to 43-101 or JORC compliance as preferred by AMAK.

All work carried out by Power Metal will come under the Company's strict ESG guidelines to ensure safe, responsible and environmentally friendly practices are maintained to the highest degree at all times.

About the Qatan Exploration licence

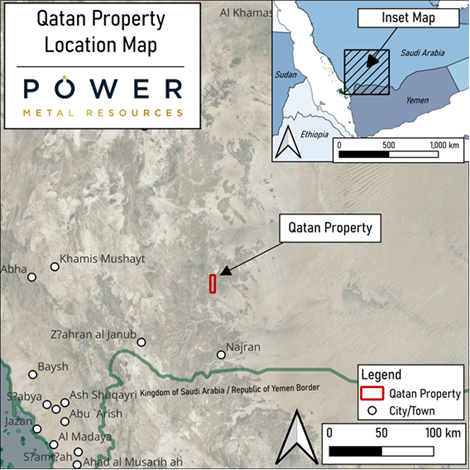

The 72.247 km² Qatan exploration licence is located approximately 70 km east of the AMAK mines, and 32 km to the south of the town of Yadamah, in the Najran Province, in the south of Saudi Arabia. See Figure 2.

Figure 1. View of Qatan Exploration Licence, Saudi Arabia, June 2024

Figure 2. Location of Qatan Licence, Saudi Arabia.

The last exploration work carried out on the licence was in 2017 when AMAK engaged SRK Exploration Ltd to conduct a data review and carry out some additional drilling on the Habdah prospect within the licence.

Within the Qatan licence, AMAK has applied for a low-grade hematite ore Small Mining Licence after exploration confirmed the absence of precious and base metals potential, and therefore, this area is excluded from this Proposed Agreement; it comprises 1.84km2, the Nuham mining license, the location of which is shown in Figure 3.

Figure 3: Location of excised Nuham Mining Licence within Qatan Exploration licence, June 2024

About Al Masane Al Kobra Mining Company

AMAK is a leading publicly listed mining company in Saudi Arabia focussed on exploration and mining for base metals, precious metals and industrial minerals with two mines (the Al Masane Copper Zinc underground mine and the Guyan Gold mine) producing copper and zinc concentrates, and gold and silver dore. In additional, AMAK has 21 exploration tenements throughout Saudi Arabia covering base and precious metals and industrial minerals to support long term mining activities through further discoveries.

AMAK annual production is currently 25-35 koz of gold dore, 40-50 koz of silver dore, 30-40 kt of copper concentrate, and 60-80 kt of zinc concentrate. Copper and zinc concentrates also contains saleable quantities of gold and silver.

AMAK Exploration plans to extend the life of mine to more than 20 years with resource developments at deeper levels, brownfield exploration and greenfield exploration but also through reconnaissance license evaluation and application of new exploration licenses in the Kingdom.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Sean Wade (Chief Executive Officer)

|

+44 (0) 20 3778 1396 |

|

|

|

|

SP Angel Corporate Finance LLP (Nomad and Joint Broker) |

|

|

Ewan Leggat/Caroline Rowe

|

+44 (0) 20 3470 0470 |

|

|

|

|

Tamesis Partners LLP (Joint Broker) |

|

|

Richard Greenfield/Charlie Bendon |

+44 (0) 20 3882 2868 |

|

|

|

|

BlytheRay (PR Advisors) Tim Blythe/Megan Ray/Alastair Roberts |

+44 (0) 20 7138 3204 |

|

|

NOTES TO EDITORS

Power Metal Resources plc (AIM:POW,OTCQB:POWMF) is a London-listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa, Saudi Arabia and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.