Data Centers Plan to Reduce Reliance on Grid Finds Bloom Energy’s 2026 Power Report

- As more gigawatt-scale data centers come online, developers are taking power into their own hands; one-third of data centers to be fully off-grid by 2030

-

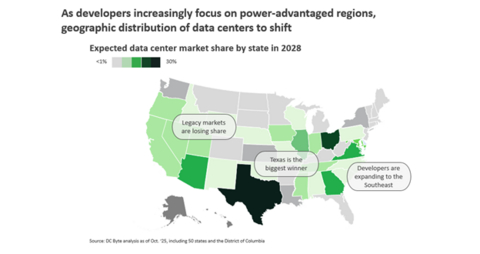

Data centers are shifting to power-advantaged regions: Texas’ data center load is poised to more than double to 30% of total

U.S. demand by 2028;Georgia leads growing boom in Southeast -

Legacy players like

California andOregon stand to lose half their relative market share

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260120114782/en/

The report’s findings indicate that:

-

Power availability is creating new geographic winners and losers:

Texas is poised to capture nearly 30% ofU.S. data center market share by 2028 andGeorgia's market share is expected to grow by 75% (from 4% of the total data center market to 7%) as developers expand deeper into the Southeast. In contrast,California ,Oregon ,Iowa , and Nebraska’s respective relative market shares are expected to drop by more than 50%. -

More data centers are approaching gigawatt scale: Over 50% of new data center campuses are predicted to exceed 500 MW by 2035 and nearly one-third of new data center campuses to exceed 1 GW, with each 1 GW campus consuming roughly as much electricity as the entirety of

San Francisco . -

The power expectation gap is widening in key hubs: Utilities project delivery timelines are approximately 1.5-2 years longer than hyperscalers and colocation providers expect. Over the past six months, the expectation gap has widened in three critical hubs –

Northern Virginia , theBay Area , andAtlanta . - Data center developers plan to make big bets in off-grid power: Hyperscalers and colocation providers expect that roughly one-third of data centers in 2030 will use 100% onsite power, a 22% increase from the previous report six months ago. Developers surveyed believe that, by 2030, onsite power will be a leading solution to minimizing development timelines and costs.

- Higher‑voltage and DC electrical architectures are moving from roadmap to reality. As AI campuses scale to gigawatts, operators are redesigning power systems to handle denser loads and faster build schedules. 45% of respondents expect to adopt direct‑current (DC) distribution architectures in their new data centers by 2028. These designs are likely to be incorporated into data centers entering development this year.

“Data center and AI factory developers can’t afford delays. Our analysis and survey results show that they’re moving into power‑advantaged regions where capacity can be secured faster—and increasingly designing campuses to operate independently of the grid,” said

The 2026

About

Forward Looking Statements

This press release contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or the negative of these words or similar terms or expressions that concern Bloom’s expectations, strategy, priorities, plans, or intentions. These forward-looking statements include, but are not limited to, the intentions of developers with respect to their plans to power data centers, the percentage of sites expected to be off-grid, the potential of regional shifts in data centers based upon power availability and the magnitude of such shifts, the role of “AI factories” and data center density in these trends, potential changes in percentage of market share in various data center markets, expectations with respect to size of new data center campuses and the power requirements of such campuses, expectations of utilities as well as hyperscalers and colocation providers with respect to timeline to provide power for new data center campuses, potential advantages of onsite-powered campuses, the percentage of sites expected to implement DC distribution architectures, and the role of AI in driving demand. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors, including, but not limited to, risks and uncertainties detailed in Bloom’s

View source version on businesswire.com: https://www.businesswire.com/news/home/20260120114782/en/

Media

Investors

Source: