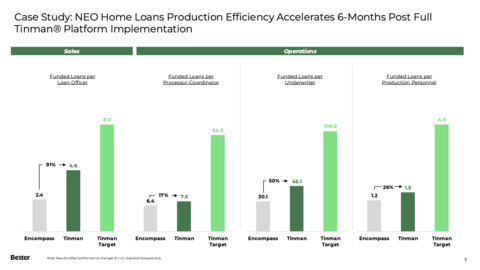

Better Marks One-Year Partnership with NEO Home Loans — NEO Loan Officers See 91% Growth in Funded Loans 6 Months After Implementing Tinman® AI Platform

The NEO powered by Better collaboration highlights strong production efficiency and cost gains from 2024 to 2025 after switching from Encompass to Tinman AI Platform

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260122545224/en/

The Better x NEO partnership was designed to eliminate the traditional tradeoff between speed and personalized mortgage advising. Powered by the Tinman® AI Platform, including Tinman® and Betsy™, they achieved meaningful gains across key operational and production metrics in 2025 compared to 2024.

“It’s been incredible to see the NEO team grow their business from the

NEO saw significant increases in loans funded per role across its

-

Loans funded per

U.S. loan officer increased by 91% - Loans funded per processor/coordinator grew by 17%

- Loans funded per underwriter rose by nearly 50%

-

Overall loans funded per

U.S. production personnel increased by 26%

“The Tinman AI Platform has removed friction from the system, helping NEO’s talent perform at their highest level and showing the true value of combining intelligent automation with the irreplaceable human touch,” said

These gains in production efficiency reflect the impact of Better’s Tinman® AI Platform that has allowed NEO to scale production without adding operational overhead. By automating repetitive tasks that consume 80% of loan production, the platform significantly reduces manual work and accelerates the lifecycle of the entire loan. Betsy™ can instantly resolve DTI issues by pulling loan file facts, investor and underwriting guidelines, recommend solutions and draft customer communications in seconds for loan officers. Tinman® centralizes documents and pricing, processes borrower data, and pre-fills required fields from previously completed tasks, making one-touch underwriting and closing document preparation available to underwriters, processors, and closers.

“Coming from a legacy mortgage tech stack, the difference with Tinman AI is night and day. I used to waste time navigating fragmented systems and chasing down manual processes,” shared NEO powered by Better Loan Officer,

Alongside increased production, NEO powered by Better delivered meaningful cost improvements per funded loan:

- Sales cost per funded loan decreased by 23%

- Operations cost per funded loan dropped by 29%

- Commissions per funded loan increased by 13%

These cost gains have translated directly into expanded access to homeownership by passing savings back to buyers. 82% of first-time homebuyers who purchased with NEO in 2025 were previously renters, demonstrating the platform’s ability to help renters successfully navigate the transition to homeownership despite affordability challenges. The outcome stands in contrast to broader market trends, with recent surveys showing that one in six prospective buyers abandoned their homebuying journey due to affordability or being priced out of the market; highlighting the need for a faster, more cost-effective lending model.

As the mortgage market continues to shift, the Tinman® AI Platform sets a new standard for scalable, high-performance lending. NEO Home Loans powered by Better is a case study that demonstrates sustainable growth is possible when hard working loan officers and operation teams are empowered with technology-enabled efficiency tools like Tinman® and Betsy™.

Disclaimers

Data is based on internal operational data comparing 2024 and 2025 performance; results may vary by organization and market conditions.

About

For more information, follow @betterdotcom on Instagram and TikTok.

About NEO Home Loans powered by Better

NEO Home Loans powered by Better is a tech-forward mortgage company committed to reshaping the lending experience through education, transparency, and personalized strategy. NEO blends cutting-edge technology with expert human guidance to help clients make smarter financial decisions. With a national footprint and a local advisor model, NEO empowers mortgage professionals to scale their businesses with greater autonomy, efficiency, and impact. NEO powered by Better is setting a new standard in lending. Learn more at neohomeloans.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260122545224/en/

Source: